Online broker comparison Switzerland: The best brokers & trading platforms 2026

Find the best online broker in Switzerland in the comprehensive trading platform comparison

Editorial note: We may earn a commission from partner links or promo codes. This compensation does not influence our editorial opinions or ratings. Learn more.

In our analysis, we compared the leading online brokers in Switzerland. The best brokers and custody accounts are characterised by low fees, strong trading platforms and high-quality customer support.

Rating of Saxo

Saxo is the most cost-efficient broker in Switzerland. The trading platform is sophisticated and offers many functions.

Swiss shares 🇨🇭

per trade

0.08% (min. CHF 3)

European shares 🇪🇺

per trade

0.08% (min. EUR 3)

Regulated in Switzerland

✅

Real cryptocurrencies

❌

Requirements

none

Excellent – 1st place

5

Custody fees

per year

CHF 0

USA shares 🇺🇸

per trade

0.08% (min. USD 1)

ETF

per trade

Same fees as for shares

Savings plans

✅

Entry in share register

❌

Rating of Swissquote

Swissquote impresses with a wide range of products and a fair fee structure.

Swiss shares 🇨🇭

per trade

from CHF 3 (max. CHF 190)

European shares 🇪🇺

per trade

from EUR 5 (max. EUR 190)

Regulated in Switzerland

✅

Real cryptocurrencies

✅

Requirements

none

Very good – 2nd place

4.9

Custody fees

per year

from CHF 80 (max. CHF 200)

USA shares 🇺🇸

per trade

from USD 3 (max. USD 190)

ETF

per trade

Same fees as for shares, except for the so-called ETF Leaders maximum fee of CHF/EUR/USD 9

Savings plans

✅

Entry in share register

✅

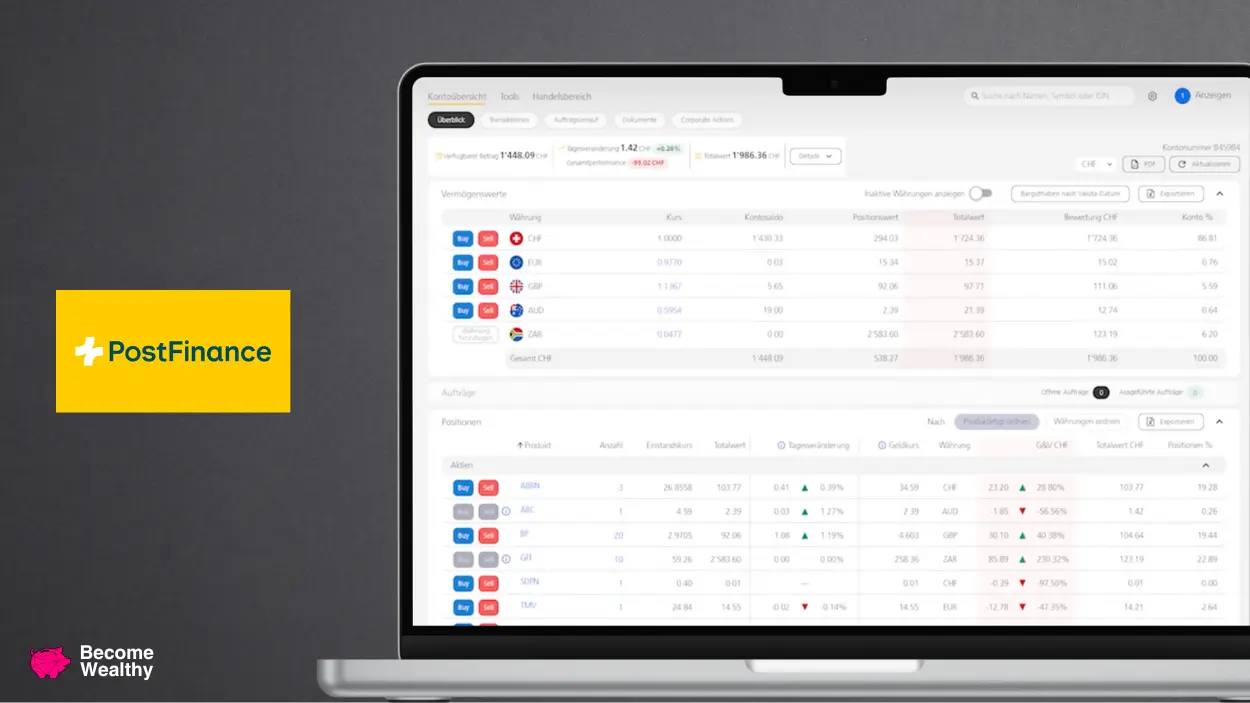

Rating of PostFinance

The trading platform was developed by Swissquote and is often more expensive, despite brokerage credits.

Swiss shares 🇨🇭

per trade

from CHF 6 (max. CHF 300)

European shares 🇪🇺

per trade

from EUR 15 (max. EUR 300)

Regulated in Switzerland

✅

Real cryptocurrencies

✅

Requirements

Bank account (CHF 60 per year)

Good – 3rd place

4.4

Custody fees

per year

CHF 72 (the deposit fee is credited quarterly as trading credit)

USA shares 🇺🇸

per trade

from USD 15 (max. USD 300)

ETF

per trade

Same fees as for shares

Savings plans

✅

Entry in share register

✅

No welcome offer

Rating of Migros Bank

Migros Bank is expensive for small to medium-sized trades due to the flat fee.

Swiss shares 🇨🇭

per trade

CHF 40 (0.02% surcharge for trading volume over CHF 100,000)

European shares 🇪🇺

per trade

CHF 40 (0.1% surcharge for trading volume over CHF 100,000)

Regulated in Switzerland

✅

Real cryptocurrencies

❌

Requirements

Bank account (free)

4th place

2

Custody fees

per year

0.23% (min. CHF 50 per year)

USA shares 🇺🇸

per trade

CHF 40 (0.1% surcharge for trading volume over CHF 100,000)

ETF

per trade

Same fees as for shares

Savings plans

❌

Entry in share register

✅

No welcome offer

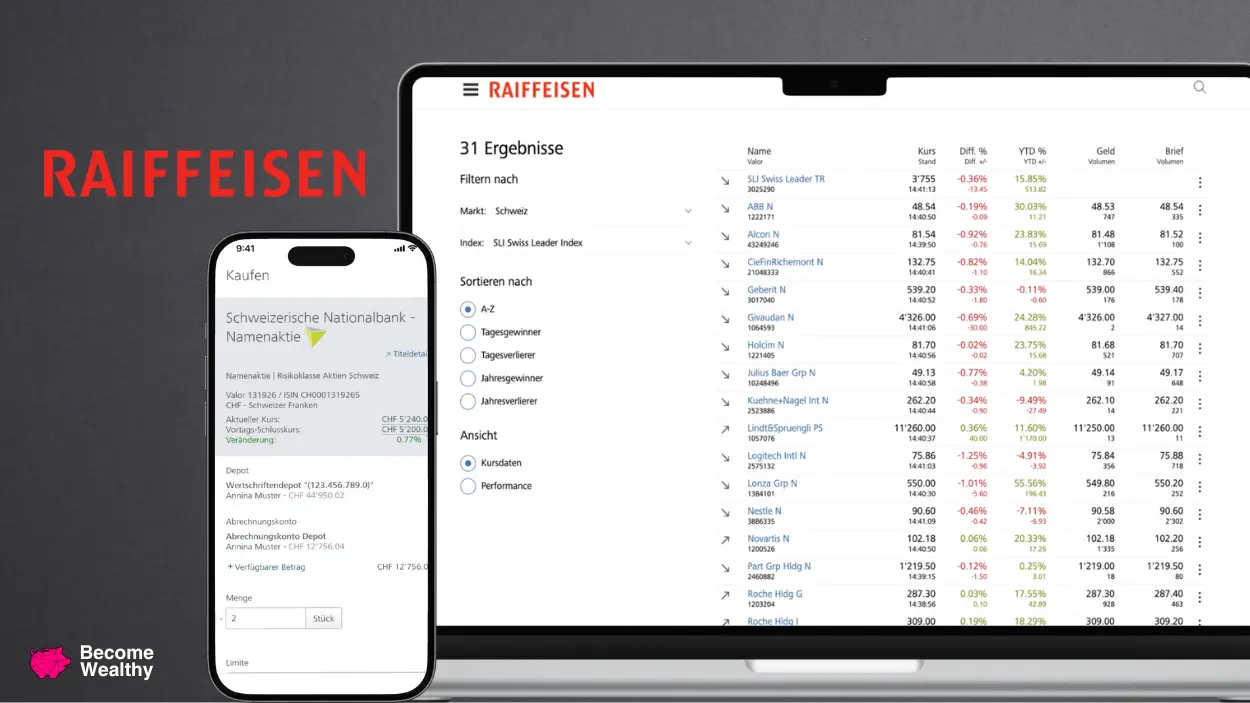

Rating of Raiffeisen

Raiffeisen's offering is characterized by high trading and custody fees without any cap.

Swiss shares 🇨🇭

per trade

0.5% to 0.08% (min. CHF 40)

European shares 🇪🇺

per trade

0.75% to 0.35% (min. CHF 50)

Regulated in Switzerland

✅

Real cryptocurrencies

❌

Requirements

Bank account (CHF 60 per year)

5th place

1.7

Custody fees

per year

0.25% (min. CHF 50 per year)

USA shares 🇺🇸

per trade

0.75% to 0.35% (min. CHF 50)

ETF

per trade

Same fees as for shares

Savings plans

❌

Entry in share register

✅

No welcome offer

Rating of UBS

Due to high trading and custody fees without a cap, UBS performs poorly.

Swiss shares 🇨🇭

per trade

0.9% to 0.2% depending on trading value (min. CHF 40)

European shares 🇪🇺

per trade

1.425% to 0.75% depending on trading value (min. CHF 60)

Regulated in Switzerland

✅

Real cryptocurrencies

❌

Requirements

Bank account (CHF 60 per year)

6th place

1.2

Custody fees

per year

0.35%

USA shares 🇺🇸

per trade

1.425% to 0.75% depending on trading value (min. CHF 60)

ETF

per trade

Same fees as for shares

Savings plans

❌

Entry in share register

✅

No welcome offer

Rating of ZKB

The ZKB is the most expensive: high minimum, trading and deposit fees.

Swiss shares 🇨🇭

per trade

0.5% to 0.3% (min. CHF 50) plus execution fee of 0.005-0.01% (min. CHF 1.50)

European shares 🇪🇺

per trade

0.7% to 0.5% (min. CHF 50) plus brokerage fee of up to 0.02%

Regulated in Switzerland

✅

Real cryptocurrencies

✅

Requirements

Bank account (free)

7th place

1

Custody fees

per year

0.3% (at least CHF 36 per Swiss security and CHF 48 per foreign security per year)

USA shares 🇺🇸

per trade

0.7% to 0.5% (min. CHF 50) plus brokerage fee of up to 0.04%

ETF

per trade

Same fees as for shares

Savings plans

❌

Entry in share register

✅

No welcome offer

The best online brokers in Switzerland: Our recommendations in 2026

As high fees quickly eat away a large part of the return on your investment, choosing the right broker is essential - however, long fee fact sheets and the large selection of trading offers can quickly become overwhelming.

To make your choice easier, we have tested the leading online brokers in Switzerland. The best brokers and custody accounts impress with low fees, powerful trading platforms and good customer service. In this comparison, we have only included brokers that are regulated in Switzerland and subject to Swiss deposit protection.

🏆 Best brokers 2026

When choosing the best broker and securities account, you should pay attention to low fees, as high costs reduce your returns. We also follow this principle when designing the test criteria. |

Welcome offer 🚀We have agreed welcome conditions with the test winners for you:

|

Note: We are an independent Swiss financial platform. If you click a link (affiliate link) or use one of our promo codes, we receive a commission from the provider — at no additional cost to you. Account opening is carried out exclusively with the provider; we do not receive any personal data. Our tests, reviews, and rankings remain unaffected by this. Learn more |

☝️ At a glance

|

Overview of the Swiss brokers tested

In this comparison, we analyse the leading brokers in Switzerland. All providers tested are regulated in Switzerland and cash deposits are protected up to CHF 100,000 by the deposit protection scheme. The following Swiss brokers and custody accounts are compared:

Migros Bank

PostFinance

Raiffeisen

Saxo

Swissquote

UBS

ZKB

What is a custody account?

If you want to invest in shares or ETFs, you need a custody account. This is where your securities - i.e. shares, ETFs, funds, etc. - are kept.

Your custody account is linked to a settlement account. The settlement account has its own IBAN. This allows you to quickly and easily pay your capital to be invested into your settlement account. At the same time, dividend income and proceeds from the sale of securities are also credited to your settlement account.

What is the difference between a custody account and a broker?

The two terms "custody account" and "broker" are usually used interchangeably.

A custody account - more precisely a "securities account" - is an account with an online broker that you can use to hold and manage securities (shares, bonds, ETFs).

A broker is a financial service provider that acts as an intermediary between you as an investor and the financial markets. In other words, a broker forwards your trading order to a trading centre.

Since securities trading requires a securities account, all brokers also offer one - which is why the terms "securities account" and "broker" are often used interchangeably.

Which brokers does Become Wealthy recommend?

So that you can invest as easily and cost-effectively as possible, we have identified the best custody account among the leading Swiss brokers. We have not included Swiss neo-brokers such as neon or Yuh in the comparison, as the range of shares and ETFs offered by both is still very limited.

The most favourable provider is Saxo Bank, followed by Swissquote. Can't make up your mind? We have once again compared the two top-ranked providers in this comparison in detail.

1st place Saxo Bank: test winner and best online broker

The test winner of the broker comparison is Saxo Bank, which clearly offers the most favourable investment solution since its fee reduction. Investments can be bought and sold easily via the web platform and trading app. For the majority of investors, Saxo offers everything that can be expected from a trading platform. If you are looking for the lowest possible fees and can do without functions such as share register entries, Saxo is the right choice. Saxo not only convinces with low fees on Swiss stocks, but also on foreign stocks and ETFs.

There are no custody account fees at Saxo. Securities lending also makes it possible to temporarily lend shares and ETFs to other market participants. In return, the borrower transfers other securities as collateral and pays interest. We have compared the standard "Classic" fees in the broker comparison. From a minimum deposit of CHF 250,000, the fees fall even further, making Saxo even more attractive in terms of price for so-called "Platinum" clients in these cases.

2nd place Swissquote Bank: Good price-performance ratio

If you are looking for the most comprehensive overall package, you will find it at Swissquote. Swissquote has a very sophisticated and user-friendly trading platform. Both the app and the web platform have a clear and modern design and impress with good trading overviews.

You also have access to 3 million financial products. No other Swiss broker offers such a large selection of financial products. Swissquote also gives you access to real cryptos, whereas many other brokers only allow you to trade crypto derivatives. Swissquote is also one step ahead when it comes to offering Swiss bonds and index funds.

Anyone looking not only for a good broker but also a fully-fledged online bank will also find what they are looking for at Swissquote: From everyday banking - including debit card, mobile payment and Twint - to predefined investment strategies with Invest Easy, pillar 3a solutions or mortgages, Swissquote offers everything from a single source. So you no longer need any other bank besides Swissquote.

3rd place for PostFinance: Swissquote technology with lower performance

The PostFinance e-trading platform was developed by Swissquote. In a cost comparison, PostFinance performs slightly worse than Swissquote in many cases, despite the brokerage credit.

At the same time, Swissquote gives you unrestricted access to all functions, which is why we recommend Swissquote directly. Last but not least, PostFinance e-trading can only be used in conjunction with a PostFinance private account, which in turn costs at least CHF 5 per month (these costs were not taken into account in the broker comparison). This means that PostFinance e-trading is particularly suitable for those who already have a PostFinance account and also wish to manage their custody account with the same bank.

How do you find the best broker or the best custody account?

When choosing the best broker, you need to ask yourself what is important to you. Do you value the lowest possible fees, the largest possible selection of tradable securities or do you value other banking services such as a debit card, mortgage or pillar 3a? Depending on how you answer these questions, a different broker may be best for you. To summarise, consider the following when looking for the best custody account:

Fees: Pay attention to low fees, as high costs reduce your return. The fees for the investment products you frequently use (e.g. Swiss equities) are particularly important.

Financial products: Is access to the most important securities such as shares or ETFs important to you or would you like to go further and trade options or cryptocurrencies, for example?

Functions: Additional functions such as savings plans or the option of being entered in the share register can also influence the choice of broker.

We tested according to the following criteria

In this broker comparison, we test the leading brokers in Switzerland. Only brokers domiciled in Switzerland and supervised by the Swiss Financial Market Supervisory Authority (FINMA) that have a fully-fledged Swiss banking licence are considered - all of the brokers tested are therefore Swiss banks. In addition, all of the brokers tested offer deposit protection for cash deposits of up to CHF 100,000.

We use objective, data-based methods to calculate the rating so that the result is not influenced by subjective criteria. To this end, we focus solely on the fees (trading and custody fees and, where applicable, the costs of real-time information). Although various functions (e.g. entry in the share register) are shown in the comparison, they have no influence on the rating, as these are not essential requirements for all of them.

We base the investment volume on data from the Swiss Federal Statistical Office, according to which every household in Switzerland saves an average of CHF 1,460 per month. Based on this savings amount, we assume for the calculation that an ETF totalling CHF 1,200 is traded each month as well as additional individual trades of two Swiss securities, two US securities and two German securities of CHF 500/USD/EUR each per year. The custody account volume is CHF 100,000, which corresponds to an annual transaction volume of CHF 17,400.

To summarise, the calculation bases are as follows, whereby a transaction can be a purchase or sale:

Custody account assets: CHF 100,000

ETF transactions (SIX): 12x per year at CHF 1,200 each

Share transactions Switzerland (SIX): 2x per year at CHF 500 each

Share transactions USA (NASDAQ / NYSE): 2x per year at CHF 500 each

Share transactions Europe (XETRA): 2x per year at CHF 500 each

What are the costs?

Various costs can be incurred for a custody account. If you try to compare the various offers, you will quickly realise that the different fee models make it difficult to compare them. We have rummaged through the price lists for you and done the maths so that you can quickly get an overview of the brokers.

The most important costs are custody account fees and trading fees (brokerage fees).

a) Comparison of custody account fees - major differences between brokers

Most brokers charge custody account fees depending on the custody account volume. Some providers, such as Swissquote or PostFinance, apply a maximum fee that caps custody costs. Saxo Bank does not charge any custody fees. As shown in the table, there are significant differences in the level of custody fees.

Comparison of custody account fees for different custody account volumes (in CHF)

Broker | Fr. 10’000 | Fr. 50’000 | Fr. 100’000 | Fr. 500’000 | Fr. 1Mio. |

|---|---|---|---|---|---|

Saxo | 0 | 0 | 0 | 0 | 0 |

Swissquote | 80 | 80 | 100 | 200 | 200 |

PostFinance | 72 | 72 | 72 | 72 | 72 |

Migros Bank | 23 | 115 | 230 | 1’150 | 2’100 |

Raiffeisen | 50 | 125 | 250 | 1’250 | 2’500 |

UBS | 35 | 175 | 350 | 1’750 | 3’500 |

ZKB | 50 | 150 | 300 | 1’500 | 3’000 |

b) Trading fees - Saxo clearly the most favourable

Brokers charge a fee for the purchase and sale of securities. Trading fees (also known as order fees) generally increase in line with the trading volume; only Migros Bank charges a flat fee (with a surcharge of up to 0.1% for trades over CHF 100,000). Some brokers combine a percentage trading fee with a minimum fee (for Swiss securities around CHF 40 at Raiffeisen and UBS or CHF 50 at ZKB). These brokers are therefore not suitable for smaller trading orders. Swissquote charges a fee of CHF/USD/EUR 0.85 to cover the costs of the platform's real-time information - we have included this in the following cost overview.

Trading fees for shares and ETFs Switzerland on the SIX Swiss Exchange for various transaction amounts (in CHF) 🇨🇭

Broker | Fr. 0-500 | Fr. 500-1’000 | Fr. 1’000-2’000 | Fr. 2’000-10’000 |

|---|---|---|---|---|

Saxo* | 3 | 3 | 3 | 3-8 |

Swissquote | 3.85 | 5.85 | 10.85 | 30.85 |

* Swissquote ETF-Leader | 3.85 | 5.85 | 9.85 | 9.85 |

PostFinance | 6 | 12 | 20 | 20-30 |

Migros Bank | 40 | 40 | 40 | 40 |

Raiffeisen | 40 | 40 | 40 | 40-50 |

UBS | 40 | 40 | 40 | 120 |

ZKB | 50 | 50 | 50 | 50 |

* Saxo distinguishes between three fee levels (Classic [minimum deposit 0.-], Platinum [minimum deposit 250,000.-] and VIP [minimum deposit 1 million]). In this comparison, we analyse the Classic level. From the Platinum level upwards, Saxo is 30% cheaper.

Saxo is clearly the most favourable for trading Swiss equities and ETFs, followed by Swissquote. Swissquote offers an exciting feature for ETFs: a maximum fee of CHF 9 is charged for a large selection of ETFs (so-called ETF Leaders) that can be bought on the SIX. Migros Bank, Raiffeisen, UBS and Zürcher Kantonalbank are lagging behind in terms of costs.

Trading fees for USA shares on the Nasdaq / NYSE stock exchange for various transaction amounts (in USD) 🇺🇸

Broker | $ 0-500 | $ 500-1’000 | $ 1’000-2’000 | $ 2’000-10’000 |

|---|---|---|---|---|

Saxo | 1 | 1 | 1-1.60 | 1.60-8 |

Swissquote | 3.85 | 5.85 | 10.85 | 30.85 |

PostFinance | 15 | 20 | 30 | 30-35 |

Migros Bank | 40 | 40 | 40 | 40 |

Raiffeisen | 50 | 50 | 50 | 50-75 |

UBS | 40 | 40 | 40 | 40-142.50 |

ZKB | 50 | 50 | 50 | 50 |

The same picture emerges for securities traded on US stock exchanges. Here too, Saxo and Swissquote top the price table. And here again, Saxo is by far the cheapest option, while UBS quickly charges very high fees for larger trading amounts.

Trading fees for European shares on the German XETRA exchange for various transaction amounts (in EUR) 🇪🇺

Broker | € 0-500 | € 500-1’000 | € 1’000-2’000 | € 2’000-10’000 |

|---|---|---|---|---|

Saxo | 3 | 3 | 3 | 3-8 |

Swissquote | 5.85 | 10.85 | 20.85 | 30.85 |

PostFinance | 15 | 20 | 30 | 30-35 |

Migros Bank | 40 | 40 | 40 | 40 |

Raiffeisen | 50 | 50 | 50 | 50-75 |

UBS | 40 | 40 | 40 | 40-142.50 |

ZKB | 50 | 50 | 50 | 50-70 |

For European equities, the example of the German XETRA exchange shows that here too the online-only banks Saxo and Swissquote outperform their competitors PostFinance, Migros Bank, Raiffeisen, UBS and ZKB in terms of price.

c) Fee cap - only Swissquote and PostFinance with a fee cap

Anyone trading larger amounts will probably be wondering how the fees for larger trades over CHF 10,000 are calculated. Percentage fees can really add up for very high trading amounts.

Only Swissquote and PostFinance have fee caps: Swissquote has a fee cap for trades over CHF 50,000 and PostFinance for trades over CHF 150,000.

Migros Bank, Raiffeisen, ZKB and UBS apply graduated tariffs, whereby the fees generally decrease with higher transaction amounts. The fees shown in the table apply to the last fee level.

Fee capping using the example of share and ETF purchases on SIX

Broker | Capping | Fee details per trade ( final fee level) |

|---|---|---|

Saxo | ❌ | 0.08% (or 0.03%)* |

Swissquote | ✅ | CHF 190 |

PostFinance | ✅ | CHF 300 |

Migros Bank | ❌ | 0.02% + CHF 40 |

Raiffeisen | ❌ | 0.35% |

UBS | ❌ | 0.2% |

ZKB | ❌ | 0.3% |

* Saxo offers even better conditions for larger custody accounts: Classic (no minimum deposit) 0.08%, Platinum (CHF 250,000 minimum deposit) 0.05%, VIP (CHF 1 million minimum deposit) 0.03%

The fee levels shown are achieved by brokers with sliding scale tariffs for the following transaction sizes: Migros Bank >100k, Raiffeisen >100k, ZKB >250k, UBS >1million.

d) Stock exchange fees

In addition to the trading fee, any stock exchange fees may be passed on to you. The amount of the exchange fee charged depends on the exchange, among other things. As a rule, the stock exchange fees are very low and are hardly significant compared to the other costs.

e) Spread

The spread is the price difference between the bid and the ask price - i.e. the difference between the buying and selling price. In other words, you sell at the bid price and buy at the ask price. The lower the spread, the better for you. The spread tends to be lowest on exchanges with a large trading volume and during peak trading hours.

The spread in this example is the difference between the bid price (bid) and the ask price (ask). The spread in this example is therefore USD 0.03: Spread = 232.50 - 232.47 = 0.03

Bid price: 232.47

Ask price: 232.50

f) Inactivity fee

There are brokers who charge fees for longer periods of non-trading. None of the brokers tested here charge an inactivity fee. If you follow a buy-and-hold strategy and do not trade regularly, there are no fees other than the custody account fee.

g) Federal tax

The turnover tax is a transaction tax levied by the Federal Tax Administration on purchases and sales of domestic and foreign securities.

Swiss companies: 0.075%

Foreign companies: 0.15%

h) Additional services

Depending on the broker, there are additional fees, for example for registration in the share register or for using the trading platform (Swissquote, for example, charges 0.85 per order for the real-time data provided).

Security

All the brokers tested offer a high level of security.

Securities (shares, ETFs, etc.): The securities in your custody account are your property and do not fall into the bankruptcy estate in the event of the broker's bankruptcy, but are so-called special assets. In other words, your securities would be returned to you in the event of your broker's bankruptcy. Therefore, it does not matter whether a broker is perceived as a particularly "safe" Swiss bank, as the securities are held in your name and separately from the bank's balance sheet.

Deposit protection: The uninvested credit balance on the clearing account is only a claim against the broker. With Swiss brokers, however, CHF 100,000 is protected by the deposit protection system.

FINMA: In addition, all brokers tested are based in Switzerland and are monitored by the Swiss Financial Market Supervisory Authority (FINMA). FINMA intervenes if the regulatory requirements are not met.

Note: If you decide to use a foreign broker, you need to be careful. Depending on the country, such brokers are subject to lower regulatory requirements, which also increases your risk of loss. At the same time, you may have to enforce your rights abroad in the event of a dispute.

Securities lending

Currently, securities lending is only possible with Saxo and Swissquote. With securities lending, the broker lends your securities to third parties. They pay interest in return. At Saxo and Swissquote, this interest is split equally between you and the broker. There is a risk that the borrower may become insolvent. Although appropriate collateral is deposited, securities lending is still associated with a residual risk.

Availability of securities lending

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

✅ | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ |

Entry in the share register

If you want to participate in general meetings or receive dividends in kind (e.g. a Swatch watch or Calida pyjamas), you must be entered in the share register. Registration in the Swiss share register is possible with almost all of the brokers tested.

Possibility of entry in the share register

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

❌ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

Trading platform

Securities must be traded either via the app or the trading platform on the desktop. All providers tested offer a mobile app and web access. Trading by telephone or via a customer advisor is either not possible or involves higher fees. Swissquote's platform and app are clearly the most mature and modern.

Available trading platforms (web & mobile)

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

📱🖥️ | 📱🖥️ | 📱🖥️ | 📱🖥️ | 📱🖥️ | 📱🖥️ | 📱🖥️ |

Savings plan

A savings plan makes it easy to automate investments in securities. Investments are made regularly into the selected assets at a freely chosen interval. Such recurring purchases are currently only available with Swissquote, Saxo and PostFinance.

All three providers offer savings plans for selected ETFs. Swissquote and PostFinance also provide crypto savings plans. In addition, Swissquote allows investors to save in selected individual stocks.

Possibility to create savings plans

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

✅ | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

While Swissquote charges the normal fees, PostFinance charges 1% (min. CHF 1) on the investment amount.

How do I open a custody account?

Only Saxo and Swissquote allow you to open a custody account quickly and completely digitally. All you have to do is enter your details and then have your identity verified. PostFinance, Migros Bank, UBS and Raiffeisen require a bank account. At Raiffeisen, you have to make an appointment to open your account and at Migros Bank, the account opening process is not yet fully digitalised.

Opening a securities account and opening requirements

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

No bank account required | No bank account required | Bank account required (CHF 60 per year) | Bank account required (free) | Bank account required (CHF 60 per year) | Bank account required (CHF 60 per year) | Bank account required (free) |

Opening online | Opening online | Opening online | Opening online | No online opening | No online opening | No online opening |

Stock exchanges and tradable financial products

You can trade on the most important exchanges with all the brokers tested.

If you are looking for the widest range of financial products, Swissquote is the place to go. At Swissquote you have access to over 3 million financial products. At Saxo, by comparison, you have access to around 70,000 financial products.

Can I change brokers?

Yes, this is possible. You can transfer your securities from your old broker to the new broker. However, check the fees for transferring securities in advance, as these can be very high. There is usually a fee of 50 to 150 francs per position.

Tax directory Switzerland

Electronic tax cards enable tax returns to be completed quickly and easily. However, most banks and brokers charge a high fee for this service. E-tax statements are not yet available from PostFinance, only normal tax statements.

If you want to save yourself the costs, you can of course do without ordering a tax statement and transfer the securities to the securities register in the tax return yourself.

While Saxo, Swissquote, PostFinance and Raiffeisen charge a flat fee, the costs at Migros Bank, UBS and ZKB depend on the number of items in the custody account. With many securities in the custody account, it can quickly become expensive with these providers.

Costs for the e-tax statement in francs

Saxo | Swissquote | PostFinance | Migros Bank | Raiffeisen | UBS | ZKB |

|---|---|---|---|---|---|---|

✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ |

Free of charge | CHF 91.80 (flat rate) | CHF 97 (flat rate) | CHF 298 (variable) | CHF 87 (flat rate) | CHF 250 (variable) | CHF 324 (variable) |

E-statement | E-statement | No e-tax statement | E-statement | E-statement | E-statement | E-statement |

For brokers with variable fees for the tax statement, 25 positions were assumed in the securities account

FAQ

What is an online broker?

Online brokers allow you to buy and sell shares, ETFs, etc. online. Essentially, online brokers are characterised by user-friendly trading platforms through which you can make your investments independently and without advice. In the test, Saxo and Swissquote are online brokers according to the narrower definition, while Migros Bank, PostFinance, Raiffeisen, UBS and ZKB also operate physical counters in addition to the online platform.

Online brokers are usually significantly cheaper than traditional brokers, as costs can be reduced by digitalising the offering.

The design of the platforms varies greatly. Some providers rely on simple, very tidy user interfaces, while others are less intuitive. Swissquote offers by far the most sophisticated trading platform.

What tax rules apply to profits from online trading in Switzerland?

In principle, you do not have to pay tax on capital gains unless you are categorised as a professional trader by the tax authorities. Dividends are generally taxed as income in Switzerland.

How can customers avoid high fees?

We recommend that you open your custody account with an online broker or switch to one in order to benefit from favourable conditions. When switching, please note that there are often relatively high costs for the transfer of securities (usually CHF 50 - 100 per security). These costs are sometimes covered by the new broker up to a certain amount.

Are there providers without custody account fees?

There are no custody account fees at Saxo Bank.

Another alternative are neo-banks and brokers such as Yuh and neon. However, we have not included these in this comparison due to the still small number of financial products. However, the offers from Yuh and neon are a very suitable introduction, especially for younger people and beginners. Both also offer free savings plans.

Can a foreign online broker be worthwhile?

In Switzerland, fees are still relatively high compared to the international market. Consequently, there are many favourable foreign online brokers. However, you should be careful, as regulation takes place outside of Switzerland and is sometimes much less strict. There are also numerous opaque providers on the market, where you run a high risk of loss.

You should therefore only choose a foreign broker if you have seriously clarified the legal framework and any possibility of enforcing your legal claims. In terms of fees, a foreign broker is usually only worthwhile if you trade very often, as otherwise the fee advantage will fade into the background.

What should I bear in mind when buying ETFs and shares?

The most common mistake is choosing a broker that is too expensive and "eats away" your returns. Too many trades are also common mistakes - you should therefore take the well-known saying "back and forth empties your pockets" to heart.

In addition, broad diversification and a passive investment approach are recommended for successful investing.

Sources

Broker comparison • Online broker comparison • Depot comparison • Best Broker Switzerland • Best Depot Switzerland

Why you can trust Become Wealthy

At Become Wealthy, we are committed to helping you make smarter financial decisions. We adhere to strict editorial guidelines. Our comparisons are impartial, and the test results are calculated based on objective criteria to ensure that the outcome is not influenced by subjective impressions.